Trending This Week

Why This Couple Survived Alcohol Addiction

- By DivorceStories.info

- . November 7, 2024

7 Steps to Healing After Heartache: Self-Care for Single Moms

- By DivorceStories.info

- . August 21, 2024

Growing Up in Conflict: A Child’s Perspective on Divorce

- By DivorceStories.info

- . November 21, 2024

The Role of Character Witnesses in Family Court for Men

- By DivorceStories.info

- . November 28, 2024

“My Ex Won’t Talk to Me”

- By DivorceStories.info

- . September 13, 2024

The Role of Character Witnesses in Family Court for Men Seeking Custody

- By DivorceStories.info

- . November 28, 2024

Divorce Stories

5 Essentials for Raising Resilient, Happy Kids in Divorce

- By DivorceStories.info

- . November 27, 2024

Fair Divorce | DARVO

- By DivorceStories.info

- . November 25, 2024

What is a 70/30 Custody Schedule?

- By DivorceStories.info

- . November 25, 2024

Key Considerations for Divorce Later in Life

- By DivorceStories.info

- . November 22, 2024

Growing Up in Conflict: A Child’s Perspective on Divorce

- By DivorceStories.info

- . November 21, 2024

Why a Therapist Can Be More Vital in High-Conflict Divorces

- By DivorceStories.info

- . November 20, 2024

Write Away with Linda | The Divorce Magazine

- By DivorceStories.info

- . November 18, 2024

How to Walk Away from an Ex

- By DivorceStories.info

- . November 18, 2024

When Your Ex Has a Bigger Holiday Budget

- By DivorceStories.info

- . November 16, 2024

Stories

What is a Divorce Photoshoot? And Are You Ready for

- By DivorceStories.info

- . November 11, 2024

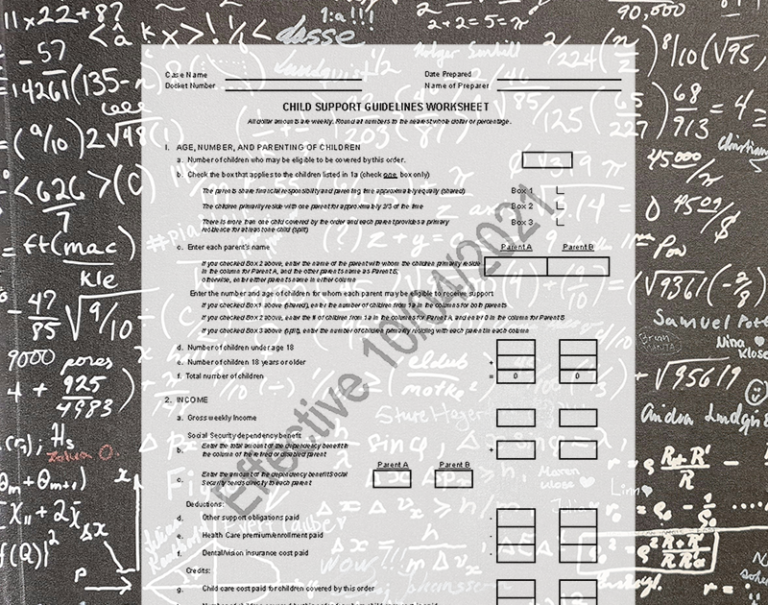

Can you Deviate from the Massachusetts Child Support Guidelines?

- By DivorceStories.info

- . November 3, 2024

One-stop resource with expert articles, a community forum, free DIY divorce forms, and a marketplace of on-demand divorce professionals. The marketplace has on-demand access to divorce professionals, like lawyers, custody experts, mediators, & more online divorce, divorce forum, online divorce lawyer, free divorce forms Take charge of your divorce with educational articles written by experts in family law, divorce, child custody, divorce and life coaching, child psychology, accounting, and more.